By clicking Get a Free Report, you agree to our Terms of Use and Privacy Policy.

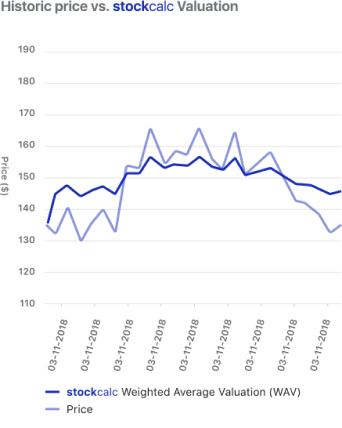

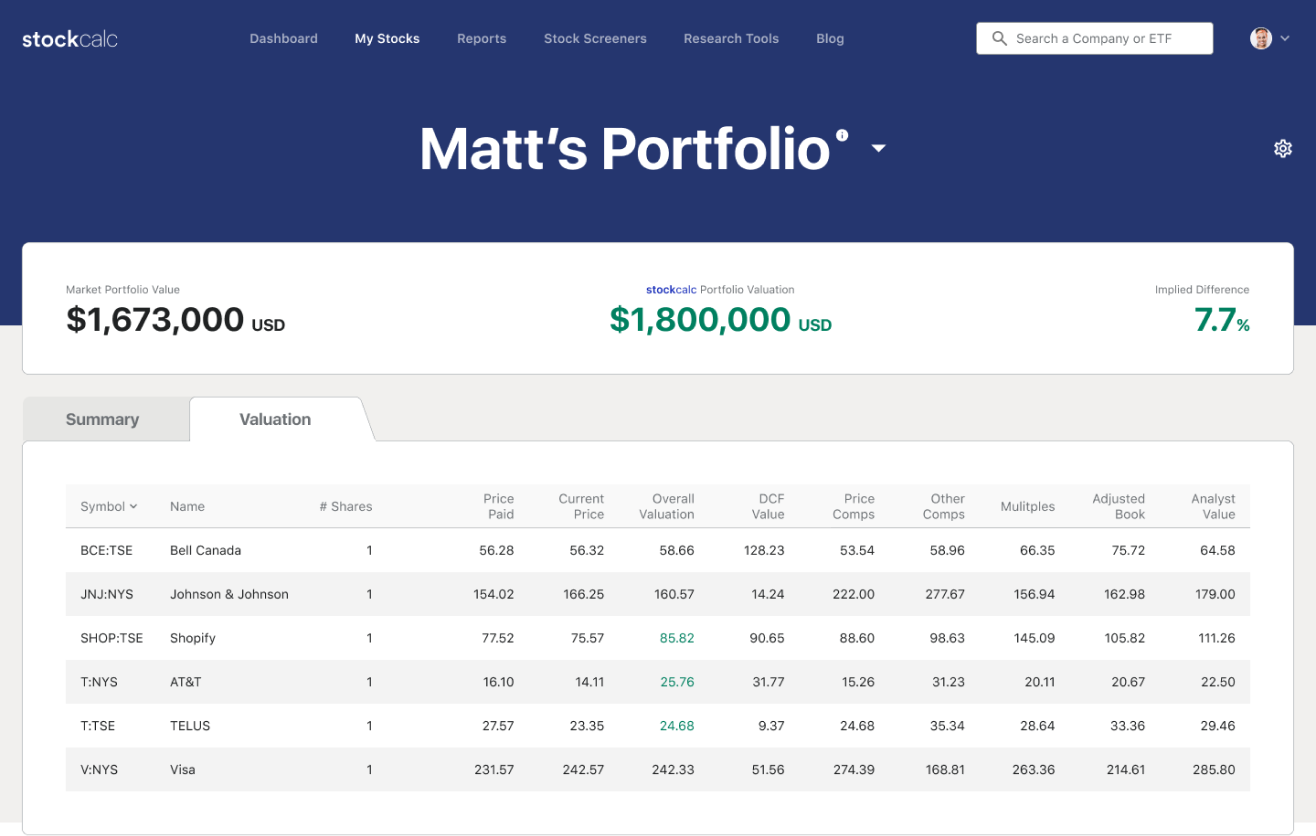

Value your portfolio holdings against market prices

Connect your portfolio with our partner institutions

.png)

Try our quick DCF tool

Disclaimer: This is an educational tool best suited for companies generating positive cash flow

Loading...

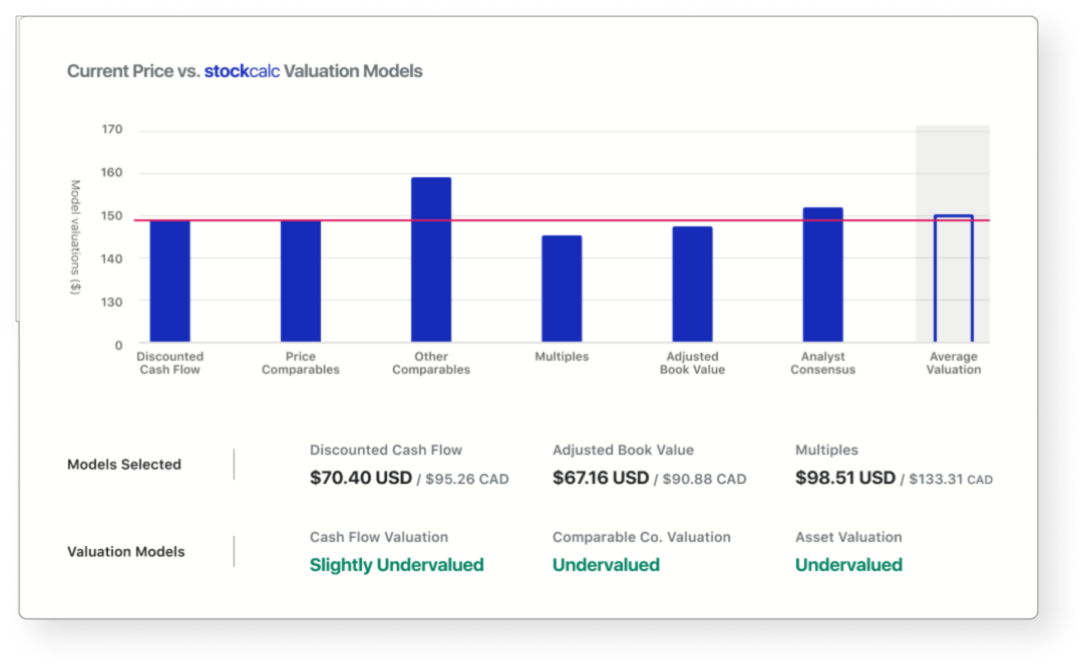

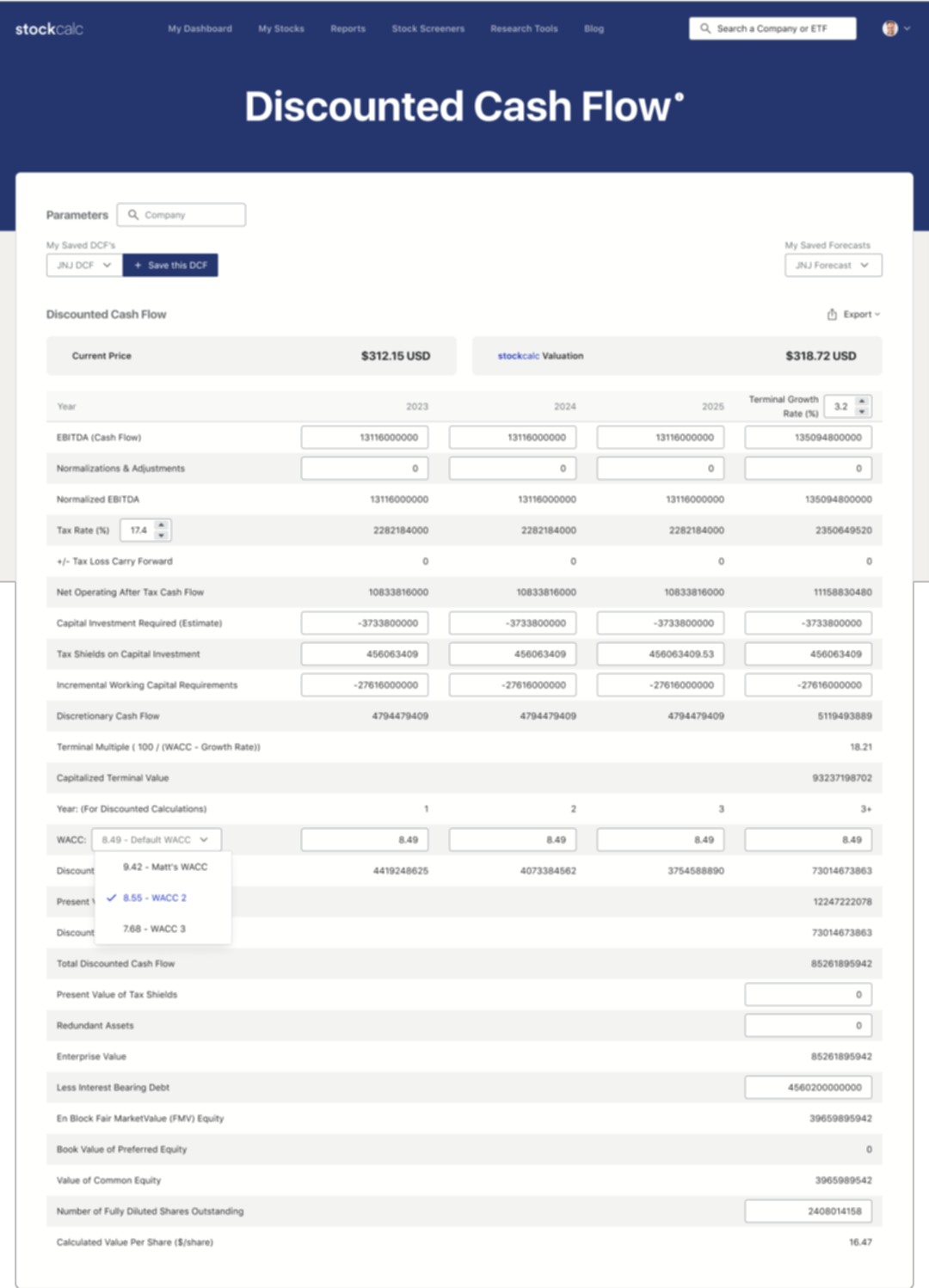

Determine a company’s value with our

discounted cash flow model

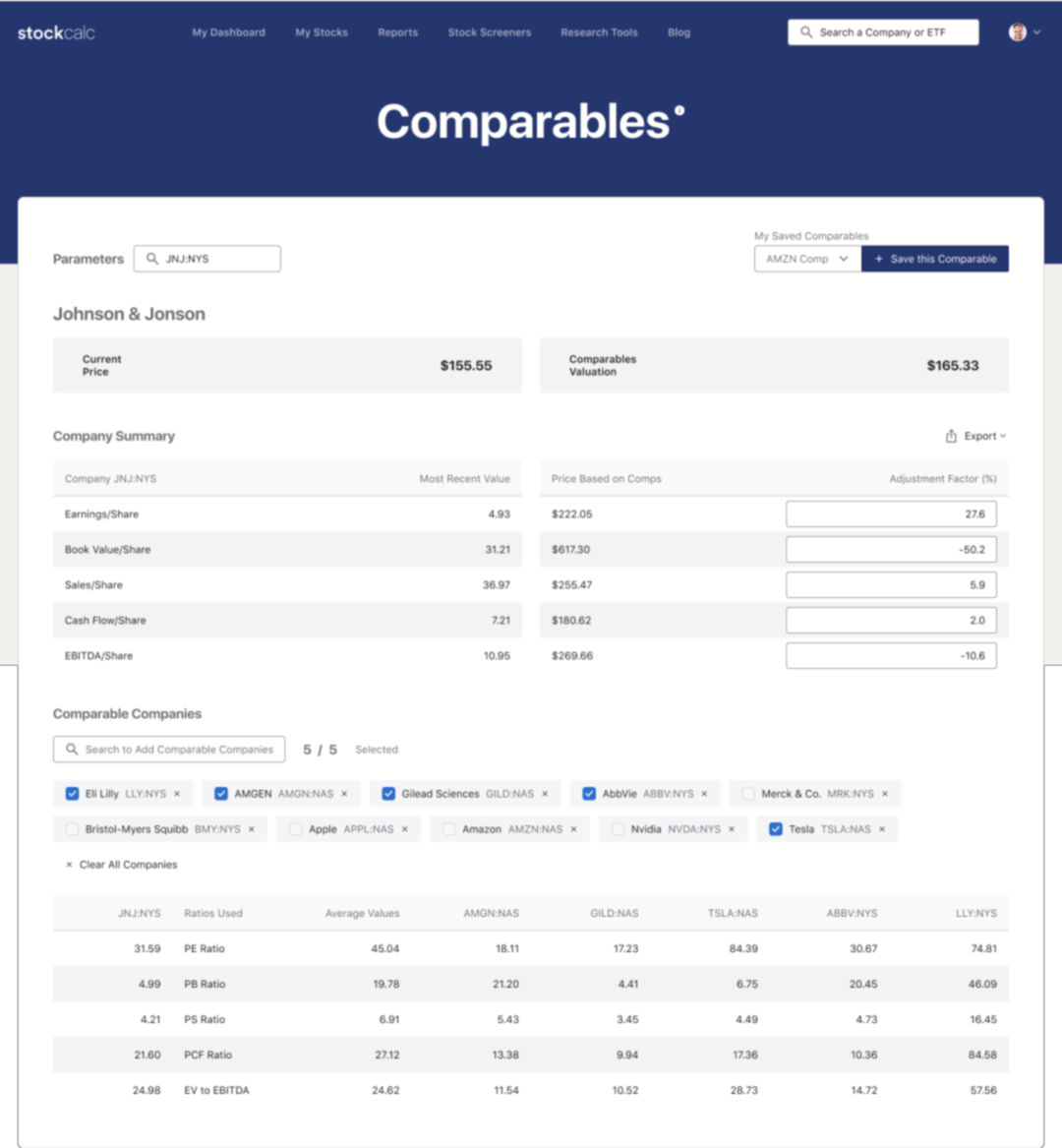

Value a company using

comparable

stocks

Our Top Undervalued Stocks

Disclaimer: This table is run once a month to show the returns

| As of Date | Symbol | Exchange | stockcalc Valuation($) |

Price at Date($) | Current Price($) | Return (%) | High Price Since($) | Low Price Since($) | Average Volume | Market Cap($) | My Watchlist |

|---|

New Offering

Focused on

short term trading?

short term trading?

Be the first to access our daily price targets for 9,000+ stocks.

Sector

2023-08-09

Undervalued Small-Cap Healthcare Stocks on TSX August 2023

The healthcare sector includes companies in biotechnology, pharmaceuticals, hospitals, home and long-term care. It also includes related medical equipment manufacturers and suppliers.

Read More